In this Article we cover Top Aditya Birla Share List name or you can say Aditya Birla penny stock list 2024. And we discuss the Financial Fundamental of All the given share of Aditya Birla Share List.

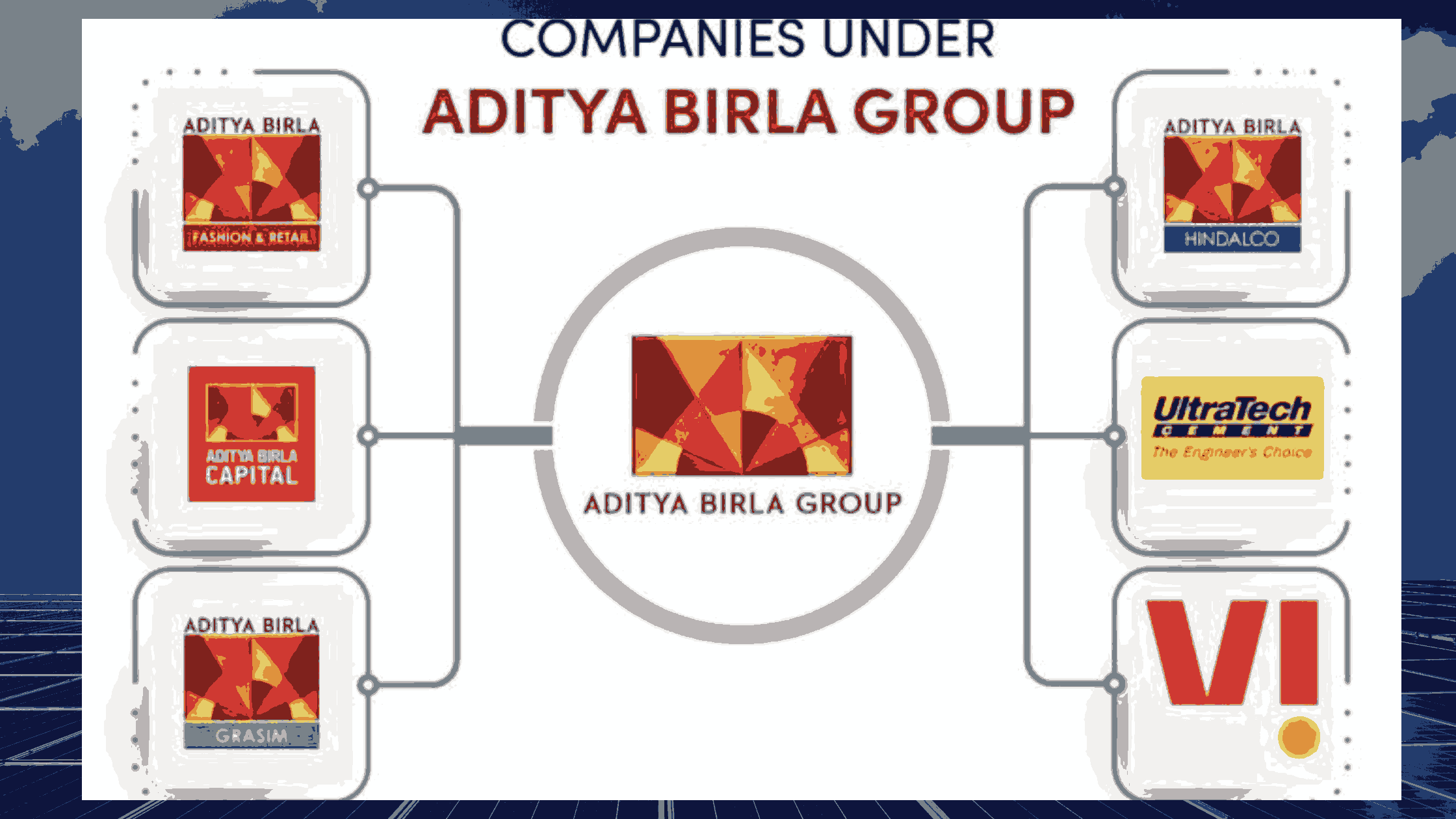

Top Aditya Birla Share List is at the 1st Aditya Birla share list is Aditya Birla Capital Ltd. And the 2nd Aditya Birla Share list is Aditya Birla Fashion & Retail Ltd. And the 3rd one Aditya Birla Share List is Aditya Birla Sun Life AMC Ltd. And 4th one of Aditya Birla Company Share List is Aditya Birla Money Ltd. And 5th one of Aditya Birla Company Share List is Grasim Industries Ltd. And 6th one of Aditya Birla Company Share List is Hindalco Industries Ltd. And 7th one of Aditya Birla Company Share List is Vodafone Idea Ltd. And 7th one of Aditya Birla Company Share List is UltraTech Cement Ltd. And all latest price of the Aditya Birla Share List is given below with table of fundamental Analysis of the Aditya Birla Share List.

Table of Contents

About Company of Aditya Birla Share List

The Aditya Birla Group (ABG) is an Indian multinational companies. the Headquarter of the Aditya group of company located in Mumbai. Aditya Birla group of Company runs many businesses world wide like pulp and fibre industry , chemicals industry , textiles Industary, carbon black,telicom and Cement. The CEO of the Aditya Birla group of Company is Mr. Kumar Mangalam Birla.

Top Aditya Birla Share List

| Company Name | LTP (₹) | Change (%) | Volume | Market Cap (₹ Cr) | 52 Week High (₹) | 52 Week Low (₹) |

|---|---|---|---|---|---|---|

| Aditya Birla Capital Ltd | 187.35 | 1.5 | 13M | 48710.28 | 199.3 | 137 |

| Aditya Birla Fashion & Retail Ltd | 226.2 | -0.4 | 2.5M | 21469.7 | 266 | 184.4 |

| Aditya Birla Sun Life AMC Ltd | 495.4 | -0.2 | 92.2k | 14264.77 | 511.95 | 307 |

| Aditya Birla Money Ltd | 114.6 | -0.4 | 54.4k | 647.03 | 148.35 | 42.65 |

| Grasim Industries Ltd | 2194.4 | -0.3 | 1.6M | 144496.68 | 2244 | 1521 |

| Hindalco Industries Ltd | 518.35 | -0.5 | 6.4M | 116484.47 | 620.5 | 381 |

| Vodafone Idea Ltd | 17.55 | 7.7 | 1.7B | 85432.85 | 18.4 | 5.7 |

| UltraTech Cement Ltd | 10000.9 | 0.4 | 304.2k | 288713.66 |

credit here

NALCO SHARE PRICE DIVIDEND HISTORY NSE 2024

Aditya Birla Fashion & Retail Ltd Share Technical Analysis.

| Metric | Value |

|---|---|

| Open | 227.95 |

| Previous Close | 227.15 |

| UC Limit | 249.85 |

| LC Limit | 204.45 |

| Volume | 2,536,384 |

| VWAP | 226.71 |

| Market Cap (Rs. Cr.) | 21,470 |

| 20D Avg Volume | 5,732,972 |

| 20D Avg Delivery | 2,447,641 |

| Beta | 0.99 |

| TTM EPS Trend | 0 |

| TTM PE Trend | — |

| Average PE | — |

| P/B Trend | 7.91 |

| Low P/B | — |

| Sector PE | 138.21 |

| Book Value Per Share | 28.58 |

| Face Value | 10 |

| Dividend Yield | — |

| P/C | 23.89 |

Aditya Birla Fashion & Retail Ltd

- Open: ₹227.95

- Previous Close: ₹227.15

- Upper Circuit (UC) Limit: ₹249.85

- Lower Circuit (LC) Limit: ₹204.45

- Volume: 2,536,384

- VWAP: ₹226.71

- Market Cap (Rs. Cr.): ₹21,470

- 20-Day Average Volume: 5,732,972

- 20-Day Average Delivery: 2,447,641

- Beta: 0.99

- TTM EPS Trend: 0

- TTM PE Trend: —

- Average PE: —

- P/B Trend: 7.91

- Low P/B: —

- Sector PE: 138.21

- Book Value Per Share: ₹28.58

- Face Value: ₹10

- Dividend Yield: —

- P/C: 23.89

Aditya Birla Share List|Aditya Birla Fashion & Retail Ltd |

Aditya Birla Fashion & Retail Ltd opening price is ₹227.95 to the pulse-pounding volume of 2,536,384.

VWAP of Aditya Birla Fashion and Retail Ltd is ₹226.71. And with a Market Cap of ₹21,470 crore.

Explore the intriguing metrics like Beta at 0.99, hinting at its market vibe, while TTM earnings and P/B ratios add to the mystery. Plus, the Book Value Per Share of ₹28.58.

Aditya Birla Capital Ltd Share Price Technical Analysis

| Metric | Value |

|---|---|

| Open | 185.55 |

| Previous Close | 184.50 |

| UC Limit | 202.95 |

| LC Limit | 166.05 |

| Volume | 13,095,853 |

| VWAP | 185.01 |

| Market Cap (Rs. Cr.) | 48,710 |

| 20D Avg Volume | 7,154,111 |

| 20D Avg Delivery | 2,240,390 |

| Beta | — |

| TTM EPS Trend | 10.38 (-45.90% YoY) |

| TTM PE Trend | 18.05 (Average PE) |

| P/B Trend | 2.99 (High P/B) |

| Sector PE | 31.64 |

| Book Value Per Share | 62.76 |

| Face Value | 10.00 |

| Dividend Yield | 0.00 |

| P/C | 24.78 |

Aditya Birla Share List|Aditya Birla Capital Ltd|Summary

The Opening price of Aditya Birla share list Aditya Birla Capital Ltd is of ₹185.55, setting the stage for an exciting day in the market. With a previous close of of Aditya Birla Capital is ₹184.50.

The Upper Circuit (UC) and Lower Circuit (LC) limits of Aditya Birla group ie. Aditya Birla Capital Ltd at ₹202.95 and ₹166.05, respectively.

Explore the company’s robust Market Cap of ₹48,710 crore, showcasing its prominence in the financial sector.

Aditya Birla Share List|Aditya Birla Capital Ltd|Summary

Aditya Birla Capital Ltd, where every number tells a story of financial strength and market dynamics. With an opening figure of ₹185.55 and a robust Market Cap of ₹48,710 crore, the company commands attention in the financial sector. Explore key metrics like volume, VWAP, and trends in EPS and P/B ratios, offering insights into its market performance and growth potential. Whether you’re a seasoned investor or a curious observer, Aditya Birla Capital Ltd invites you to delve into the world of finance and investment.

Vodafone Idea Ltd Share Price Technical Analysis

| Metric | Value |

|---|---|

| Open | 16.70 |

| Previous Close | 16.30 |

| UC Limit | 18.70 |

| LC Limit | 14.70 |

| Volume | 1,783,686,268 |

| VWAP | 17.69 |

| Mkt Cap (Rs. Cr.) | 85,433 |

| 20D Avg Volume | 404,298,602 |

| 20D Avg Delivery | — |

| Beta | — |

| TTM EPS Trend | -6.16 |

| TTM PE Trend | — |

| P/B Trend | 0.00 |

| Sector PE | 96.80 |

| Book Value Per Share | -10.51 |

| Face Value | 10.00 |

| Dividend Yield | 0.00 |

| P/C | -12.10 |

Aditya Birla Share List|Vodafone Idea Ltd| Summary

Aditya Birla Share List Vodafone Idea Ltd. opened at 16.70 and closed at 16.30. The upper circuit (UC) limit of Aditya Birla share list Vodafone Idea ltd was 18.70, while the lower circuit (LC) limit was 14.70. The company saw a high volume of trading, with a market capitalization of Rs. 85,433 crore. The 20-day average volume stood at 404,298,602 shares. Notably, the company’s trend in trailing twelve months (TTM) EPS was -6.16, and its book value per share was -10.51. Despite these fluctuations, the company didn’t offer a dividend yield. Overall, Vodafone Idea’s performance reflects significant market activity and challenges within the telecommunications sector.

Aditya Birla Share List |UltraTech Cement Ltd|

| Metric | Value |

|---|---|

| Open | 9961.20 |

| Previous Close | 9961.20 |

| UC Limit | 10957.30 |

| LC Limit | 8965.10 |

| Volume | 304,238 |

| VWAP | 9980.24 |

| Mkt Cap (Rs. Cr.) | 288,714 |

| 20D Avg Volume | 306,966 |

| 20D Avg Delivery | — |

| Beta | — |

| TTM EPS Trend | 222.14 |

| TTM EPS Trend (YoY) | +6.55% |

| TTM PE Trend | 45.02 |

| P/B Trend | 5.72 |

| Sector PE | 57.40 |

| Book Value Per Share | 1,747.05 |

| Face Value | 10.00 |

| Dividend Yield | 0.38 |

| P/C | 28.71 |

Aditya Birla Share List |UltraTech Cement Ltd|Summary

Aditya Birla Share List UltraTech Cement Ltd. opened and closed at 9961.20 with UC and LC limits at 10957.30 and 8965.10 respectively. It had a trading volume of 304,238 shares and a VWAP of 9980.24. The market cap stood at Rs. 288,714 crore. TTM EPS was 222.14 (+6.55% YoY) with a TTM PE of 45.02 and P/B of 5.72. Sector PE was 57.40, and it offered a dividend yield of 0.38 with a P/C ratio of 28.71.

How many Aditya Birla listed company

according to my research there are 7 listed company.

Is Aditya Birla a good stocks for invest?

I can’t say yes or No because its all on you can see all data then decide or ask to financer.

birla group stock list nse

1.Aditya Birla Capital Ltd.

2.Aditya Birla Fashion & Retail Ltd.

3.Aditya Birla Sun Life AMC Ltd.

4.Aditya Birla Money Ltd.

5.Grasim Industries Ltd.

Disclaimer

Disclaimer: The stock target, forecast, or predictions provided here are for reference and educational purposes only. It is essential to understand that the data may not always be reliable for making investment decisions. Therefore, any actions taken based on this information should be done at your own risk. This is not an offer to buy or sell stocks, and lalwanimarket.com and/or its operators/authors do not accept liability for any losses incurred. It is crucial to note that this is not investment advice, and subscribers should carefully consider their own circumstances and seek professional advice before making any investment decisions. Always be cautious and well-informed when dealing with investments.

Good day I am so delighted I found your webpage,

I really found you by error, while I was browsing on Yahoo for something

else, Nonetheless I am here now and would just liuke to say thanks

for a remarkable post and a aall round enjoyable blog (I also

love the theme/design), I don’t have time to go through it alll at the

moment but I have book-marked it and also added in your RSS feeds, so whhen I have time I will be

back to read muuch more, Please do keep up tthe fantastic work.

Thank you, I have just been searcching for information approximately this

topic for a while and yours iss thhe greatest I’ve discovered so far.

But, what in regards to the bottom line? Are you surte about the supply?